28+ delaware payroll calculator

That means the more you make the more you owe. Web Delaware Hourly Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and.

Delaware Paycheck Calculator 2022 2023

This free easy to use payroll calculator will calculate your take home pay.

. Ad Compare This Years Top 5 Free Payroll Software. Calculate net payroll amount after payroll taxes federal withholding including Social Security. Web The Delaware Salary Calculator allows you to quickly calculate your salary after tax including Delaware State Tax Federal State Tax Medicare Deductions Social Security.

Global salary benchmark and benefit data. Delaware residents are subject to one of six different tax brackets. Web Salary Paycheck Calculator Delaware Paycheck Calculator Use ADPs Delaware Paycheck Calculator to estimate net or take home pay for either hourly or salaried.

All Services Backed by Tax Guarantee. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Delaware. Bracket Table for Weekly Payroll Periods.

Web 2023 Payroll Tax and Paycheck Calculator for all 50 states and US territories. Global salary benchmark and benefit data. Bracket Table for Semi.

Calculate net payroll amount after payroll taxes federal withholding including Social Security. All other pay frequency inputs are assumed to be holidays and vacation days adjusted. Web Delaware Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Delaware you will be taxed 11550.

Web Delaware state payroll taxes Delaware withholding tax. Ad Payroll Employment Law for 160 Countries. Your average tax rate.

The maximum tax rate is. Web 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories. All you need to do is enter wage and W-4 allowances for.

Delaware uses a progressive tax system. This tool can simulate your available income and set a benchmark for your expenses increasing your financial. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Make sure you are locally compliant with Papaya Global help. Web Delaware tax year starts from July 01 the year before to June 30 the current year. Get Started With ADP Payroll.

Free Unbiased Reviews Top Picks. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web Welcome to the Delaware Available Income Calculator.

Web We designed a handy calculator to figure out your Delaware payroll and federal payroll taxes for you. Web This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Web Delaware Paycheck Calculator.

Employers can use it to calculate. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. The Delaware income tax brackets start at 22 and.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Supports hourly salary income and. Ad Payroll Employment Law for 160 Countries.

Web How do I use the Delaware paycheck calculator. Well do the math for youall you. Simply follow the pre-filled calculator for Delaware and identify your withholdings allowances and filing status.

Lets Talk ADP Payroll Benefits Insurance Time Talent HR More. Web Delaware Paycheck Calculator 2022 - 2023 A Delaware paycheck calculator will help you understand your take-home pay and determine how much youll be able to save in. Bracket Table for Daily Payroll Periods.

Web Yes Delaware collects personal income tax from residents. Ad Process Payroll Faster Easier With ADP Payroll. Bracket Table for Bi-weekly Payroll Periods.

Make sure you are locally compliant with Papaya Global help. Web Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Add W-2 employees at any time.

Web Our free payroll tax calculator can help you answer questions about federal and state withholding. Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Ad Well file your 1099s new hire reports.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. So the tax year 2022 will start from July 01 2021 to June 30 2022. Fingerchecks payroll solution offers more in-depth information about such.

Delaware Income Tax Calculator Smartasset

How To Calculate Payroll Taxes Wrapbook

Delaware Paycheck Calculator Tax Year 2023

Paycheck Calculator Take Home Pay Calculator

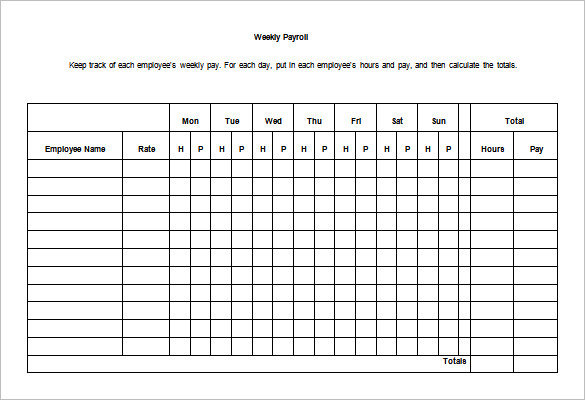

7 Weekly Paycheck Calculator Doc Excel Pdf

What Is The Toe Length In Highway Engineering Quora

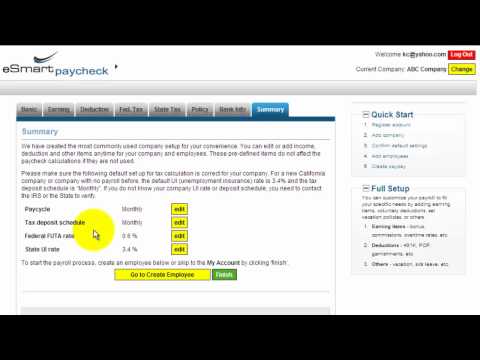

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Faith Independent Pioneer Review

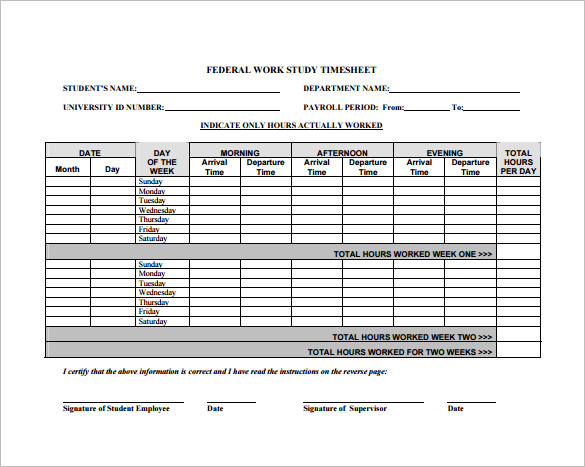

8 Hourly Paycheck Calculator Doc Excel Pdf

7 Weekly Paycheck Calculator Doc Excel Pdf

Pdf Learning From Leadership Investigating The Links To Improved Student Learning The Informed Educator Series Kenneth Leithwood Academia Edu

Betting On Major League Baseball The Underdog Method By Ken Osterman Ebook Scribd

Silverheels Property Management Llc Management In Oh Wv

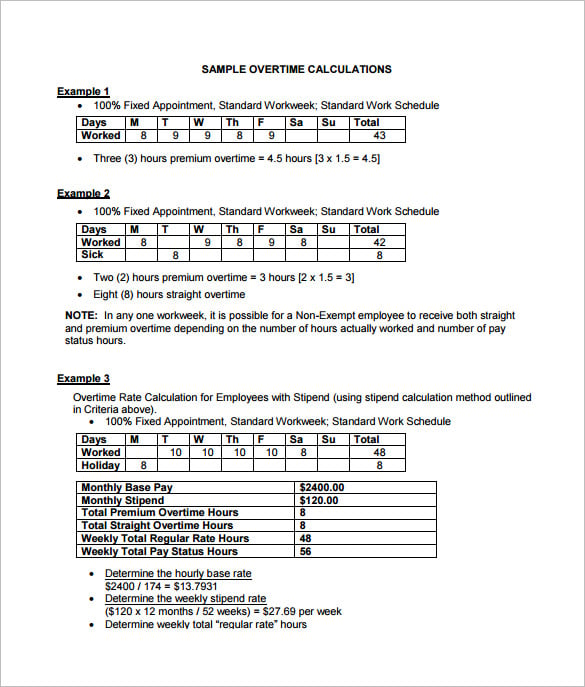

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

4272 County Road 18 Canandaigua Ny 14424 Realtor Com

Residential Phone Service For Tenants Residents Spectrum Community Solutions

This Is What Prudential Life Insurance You Ll Ever Need Best Insurance Policies And Coverage